LendingClub has become one of the more reputable destinations for online personal loans, usually an ideal method to borrow for a special need or credit card debt consolidation. It helped to originate peer-to-peer marketplace lending, which matches borrowers with investors who are willing to fund the loans. LendingClub is best suited to serve clkb with responsible payment records and established financial histories. The typical LendingClub client has a good credit score and a lengthy credit history an average of 17 years. The purpose of these loans has been refinancing a home The risk: Investors — not LendingClub — make the final decision whether or not to lend the money.

What is Lending Club?

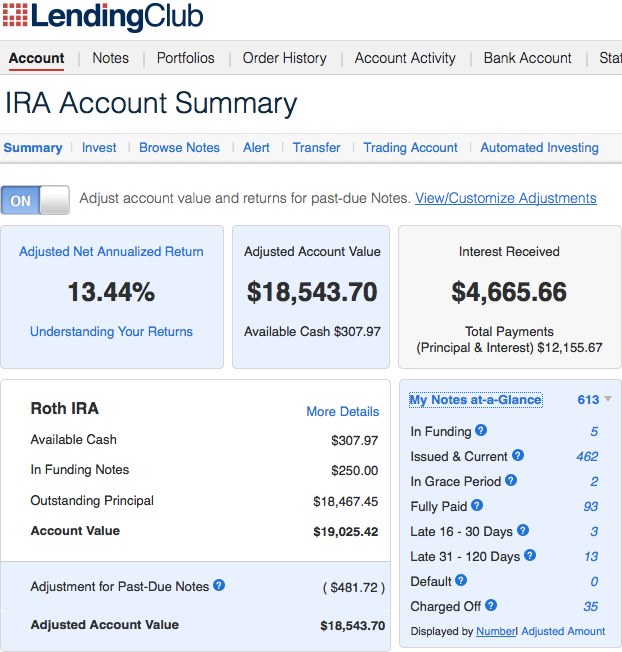

Lending Club has been transforming the banking system because of their peer-to-peer lending model that makes those exact promises. And they offer a multitude of loan products, from personal to medical to business — many collateral-free. In fact, you can get average returns of between 5. Plus, there are certain requirements you have to meet as an investor. Remember, the higher the potential reward, the higher the risk. Open an account. Notes are not available in all states. As of this writing, they are not available to residents of New Mexico, North Carolina and Pennsylvania. Depending on which state you live in, there are income requirements to invest in Lending Club. That amount allows you to start investing at a higher level and negates the need for monthly management fees. This is just one more way you can invest in your future. Learn more about Roth IRA contribution limits here.

What is Lending Club?

Lending Club Review: For Investors

If you open an account through one of these links the blog will receive a small commission from Lending Club. This review was last updated in June, Why have they been so successful? They provide excellent returns for investors and they allow quick access to funds at competitive interest rates for borrowers. Some investors read about Lending Club and dive right in.

Many people like trading foreign currencies on the foreign exchange forex market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. Forex trading can be extremely volatile and an inexperienced trader can lose substantial sums. The following scenario shows the potential, using a risk-controlled forex day trading strategy. Every successful forex day trader manages their risk; it is one of, if not the, most crucial elements of ongoing profitability. That may seem small, but losses do add up, and even a good day-trading strategy will see strings of losses. Risk is managed using a stop-loss order , which will be discussed in the Scenario sections below. Your win rate represents the number of trades you win out a given total number of trades. Say you win 55 out of trades, your win rate is 55 percent. While it isn’t required, having a win rate above 50 percent is ideal for most day traders, and 55 percent is acceptable and attainable.

I will guard your email with my life.

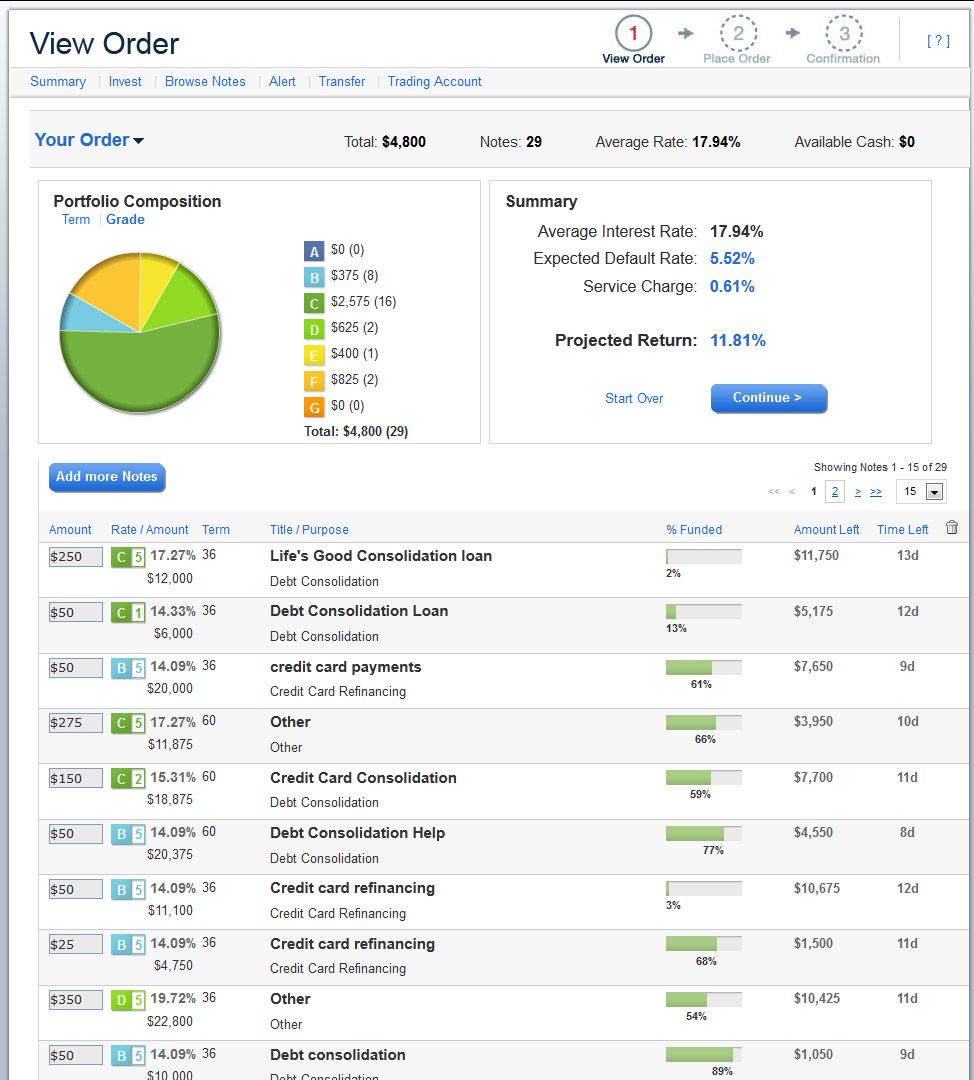

I was curious to see how the world of Peer-to-Peer Lending worked. This was different from investing in the stock market, because I became a mini-bank by lending microloans to people paying of credit card debt, home renovations, a new car, and multiple other reasons people take loans. All while I earn interest as they pay the loan off. When I started 2 years ago, I choose to individually select which micro-loans I wanted to invest in. I knew, like a traditional bank, some loans may default and you lose money. So I took the time to research each loan application and Lending Club gives you a detailed credit history to choose .

Comments

Post a Comment