Overlooking or forgetting to file your taxes from selling on eBay will lead to scrutiny from the IRS in the future. This guide will explain to eBay sellers everything they need to know about filing taxes accurately and on time. If you have consistently mpney sales or are purchasing items with the intention of resale, then you have started an online auction business. Additionally, the IRS considers your activity a business if you have made a profit during three of the last five years, including the current year. This is common for sellers on eCommerce marketplaces. As a business filing taxes, you also have deductions that you may be able to report as .

MOST READ MONEY

So it’s no surprise that the IRS doesn’t view all sellers alike in the online marketplace. You may not have to pay tax at all if you are essentially hosting an online garage sale, but if you run your eBay account more like a business, you should be reporting your sales to the IRS. Not every eBay sale is subject to income tax , but most are. If you use the site to get rid of household articles you’ve used in the past, you may qualify for «occasional garage or yard sale» treatment. According to the IRS, if your online auction sales are the Internet equivalent of an occasional garage or yard sale, you generally do not have to report income from those sales. Assuming that you originally bought the used items for more money than you are selling them for, you don’t have to report the income received from the eBay sale. If you and the IRS classify your eBay sales as a hobby , you’ll have to report the income on Form For tax years prior to , you report your expenses are an itemize deduction on Schedule A. Beginning in , you are no longer eligible to take a deduction for hobby expenses. Since you cannot use hobby expenses to reduce your hobby income, you won’t be able to use a loss from hobby sales to reduce other income. This can be important if you make money in other activities. However, if your eBay activities are considered a business , you can use your loss as a deduction to reduce your other business income, say from landscaping. Distinguishing between a hobby and a business is not an exact science. The IRS looks to many factors including:.

Tips from Other Bloggers

Submission of Form 1099-K

Do you have to pay income tax on the stuff you sell on eBay? The answer is yes — depending on how you ask the question. If you ask, «Am I legally obligated to pay income tax if I make money selling things on eBay? However, the IRS goes on to qualifying that by stating, «Some people sell a product or service online as a hobby. This income generally must be reported» [source: IRS ]. The IRS tries to make a clear distinction between individuals who sell on eBay only occasionally and hobbyists who sell on eBay more regularly. There is some gray area between the two, depending on how far you want to try and stretch the concept of an «occasional» seller. The IRS is sure to err on the conservative side, but there are no hard numbers governing how much you can earn on eBay without reporting it, or how often you have to sell through the service to be considered a «hobbyist» as opposed to an «occasional seller. To further tantalize those who might want to stretch the spirit of the law, eBay doesn’t report earnings to the government by sending its sellers forms. Therefore, the IRS has no way of knowing how much you’ve earned — unless you report it. If you’re asking if you «have» to pay income tax on the money you earn selling things on eBay, the answer is: You’re legally obligated to pay, but no one’s going to force you. If you find yourself trying to figure out if you owe income tax on the money you’ve earned selling on eBay, we’ve got related articles and fun facts below to distract and inform you while you’re deciding what to do.

By Tony Hazell for the Daily Mail. I have been forced to sell a large collection of transport memorabilia mainly paperwork built up over almost 40 years. I wanted to sell the paperwork direct to other collectors to ensure a reasonable return on their value. I have been doing this on eBay since late December last year and have kept an individual record of each sale against which I have offset the actual cost of postage, packing materials and eBay and PayPal fees. Are there limits on how much I can sell in this way? It is interested in those who make a living out of selling on the internet and are avoiding paying the tax other businesses and individuals have to pay. In short, it is after tax cheats. Much of it comes down to the motivation for selling. A spokesman gave the example of someone selling their old military history books on the internet once a month. I double-checked with Patricia Mock, tax director at accountant Deloitte. She says there are specific guidelines on the e-trader campaign at hmrc. As a collector, I think you would have a strong argument for any profits to be assessed under the capital gains tax regime. Ms Mock says that if you do not have records of what the items cost, you will need to estimate these to the best of your knowledge for HMRC. Some links in this article may be affiliate links. If you click on them we may earn a small commission.

Hobby or Business Income

Having to pay federal income taxes and having to enter your business activity on your tax return are two different topics. I believe you are asking when do you have to report your activity. Whether it causes your tax liability to increase or decrease, or whether it forces you to have to file a return that you would not have had to file beforehand is too complex for a quick answer. The first thing to decide is whether you have a business or not. Forget about whether the business had income Most businesses start out with tons of expenses and very little profit. It is in these early, lossy years when not only is it required to report it on your tax return, it is actually advantageous to report the business. YOU have to decide whether you have a business or not. In general, you have a business if you buy or manufacture items for the specific purpose of selling them on eBay at a profit regardless whether you actually generate a profit. You don’t have a business if you are simply trying to generate some cash by selling old items around the house. Someone who buys an item in bulk whether on eBay or not , then sells them in smaller quantities is running a business. Someone who goes to yard sales and buys items and then sells them on eBay is running a business.

How Much Money Can I Make on eBay Before It Affects my Social Security?

Is there a limit to how much I can sell on eBay without being chased by the taxman?

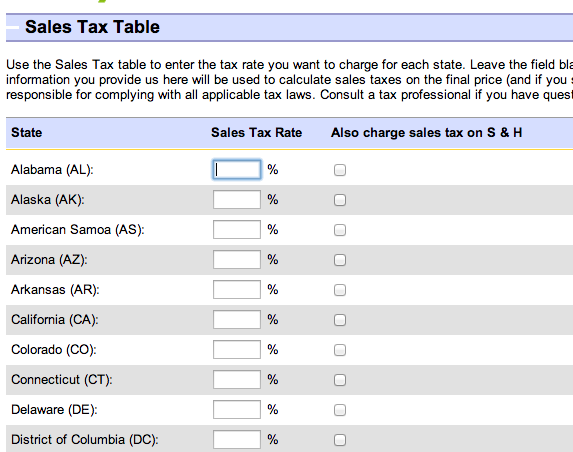

Unlike side hustles that pay cash, eBay sales are trackable through Paypal. When it comes time to file taxes, always consult a licensed tax professional for tax advice. Here is what you need to know about eBay and taxes, and a few ways to stay organized so that when tax time rolls around, you won’t be scrambling to find the correct documentation to file. The government has no way of seeing what you sold on eBay, or how much your sales. They cannot look at your sales reports ebxy access your account. According to the IRS:. You should receive Form K by January 31st if, in the prior calendar year, you received payments:. This presents the next question. According to the IRS, if you only sell occasionally and your online sales are equivalent to a physical garage sale, you do not have to report your gross sales.

Comments

Post a Comment