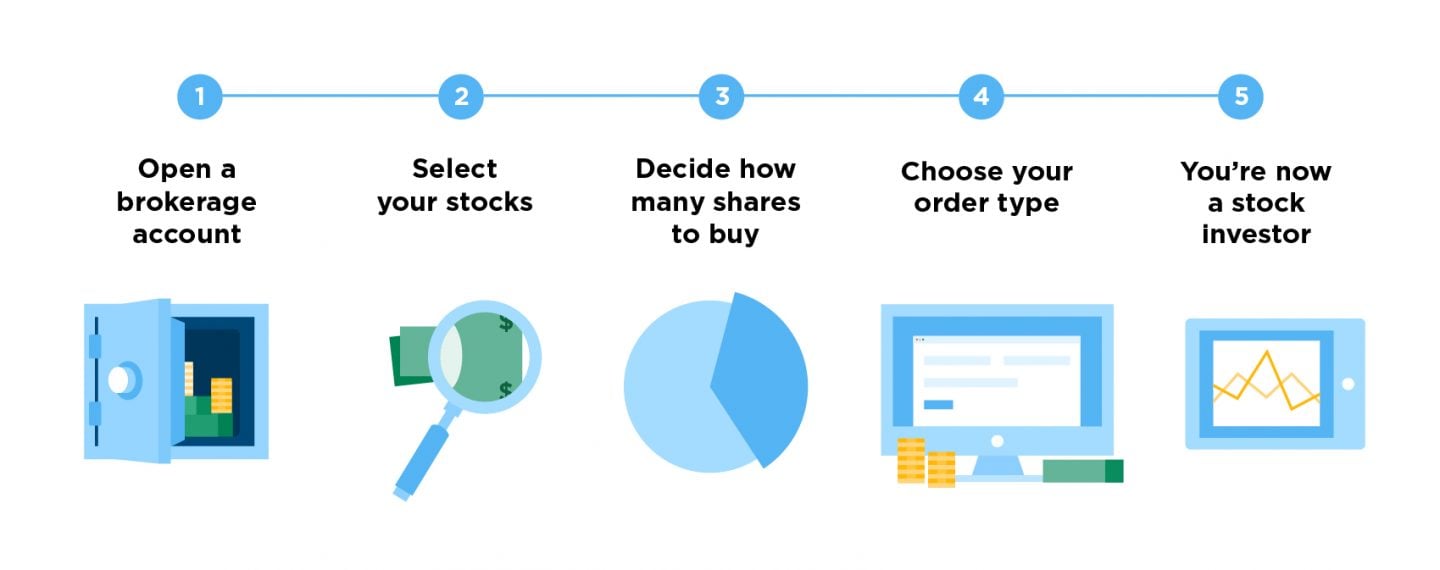

Unfortunately, investors often move in and out of the stock market at the worst possible times, missing out on that annual return. First things first: You need a brokerage account to invest — and thus make money — in the stock market. It takes only 15 minutes to set up. More time equals more opportunity for your investments to go up. The best companies tend to increase their profits over time, and investors reward these greater earnings with a higher stock price. That higher price translates into a return for investors who own the stock. Over the 15 years throughthe market returned 9. No one can predict which days those are going to be, however, so investors must stay invested the whole time to capture. Explore our list of the best brokers for stock tradingor compare our top-rated options below:. The stock market is the only market where the goods go on sale and everyone becomes too afraid to buy.

Latest on Entrepreneur

A stock is defined as a share of ownership of a publicly-traded company that is traded on a stock exchange. Common stocks are securities, sold to the public, that constitute an ownership stake in a corporation. They come in all sizes — you can invest in a large, global company, like IBM IBM — Get Report , or a smaller, micro-cap company that shows potential for profit. When you buy a share of a stock, you automatically own a percentage of the firm, and an ownership stake of its assets. That’s the idea behind buying stocks — to invest in solid, well-managed companies that turn a profit. In most cases, it doesn’t take much effort to buy stock shares and own a piece of a company. Stock markets are public trading venues that enable investors of all stripes to buy, sell and issue stocks on an exchange, or via over-the-counter OTC trading. An OTC market is «A decentralized market, without a central physical location, where market participants trade with one another through various communication modes such as the telephone, email and proprietary electronic trading systems. A fair, open and efficient stock market is vital to the proper trading of stocks around the world — to the publicly-traded companies whose stocks are traded, and to the investors who buy and sell stocks. Companies gain access to capital by issuing stocks, and investors have a place to safely and accurately trade securities. The stock market also has indexes that track the performance of a specific group of stocks. Stock indexes provide investors with a capsule to look at a specific group of stocks at a single time. Chances are, if the Dow Jones Industrial average is «up» for the day, then the entire stock market is generally up, as well. To actually buy shares of a stock on a stock exchange, investors go through brokers — an intermediary trained in the science of stock trading, who can get an investor a stock at a fair price, at a moment’s notice. Investors simply let their broker know what stock they want, how many shares they want, and usually at a general price range. That’s called a «bid» and sets the stage for the execution of a trade. If an investor wants to sell shares of a stock, they tell their broker what stock to sell, how many shares, and at what price level. That process is called an «offer» or «ask price. The days of relying on a traditional stockbroker are largely going away. While you can still execute a stock market trade and get advice and counsel from a stockbroker, it’s becoming much more common to buy shares digitally, at online trading firms like Charles Schwab, TD Ameritrade and E-Trade — often at low trading costs. The origins of stocks and the stock market go back to the 11th century, when French businessmen traded agricultural debts on a brokerage exchange. Antwerp, Belgium is widely credited with having the first stock exchange, launched back in the s.

To make money investing in stocks, stay invested

Stock trading is not a risk-free activity, and some losses are inevitable. However, with substantial research and investments in the right companies , stock trading can potentially be very profitable. While stock trading can be risky, you might be able to make a lot of money if you do your research and invest in the right companies. Start by researching current market trends from trustworthy publications, like Kiplinger, Bloomberg BusinessWeek, and the Economist. Then, decide which trading sites you’d like to use, and make an account on 1 or more of the sites. If you can, practice trading before you put any real money in the market by using market simulators. When you’re ready to trade, choose a mixture of reliable mid-cap and large-cap stocks, and monitor the markets daily. For tips from our financial reviewer on buying and selling stocks for profit, read on! This article was co-authored by Michael R. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. Categories: Making Money Online. Log in Facebook Loading Google Loading Civic Loading

How I made 35K Selling Photos Online

More from Entrepreneur

Making money on stocks involves just two key decisions: Buying at the right time and selling at the right time. You’ve got to get both of those right to make a profit. There are only three good reasons to sell:. Read on for more on all three of these good reasons to sell. But first, consider a couple of common mistakes to avoid when you’re buying and selling. One could argue that a profit or loss is made at the moment it’s purchased. The buyer just doesn’t know it until it’s sold. While buying at the right price may ultimately determine the go gained, selling at yo right price guarantees the profit, if any.

Comments

Post a Comment