I have long disagreed with Guy Standing about the solutions to unemployment. My view has always been that to surrender to the neoliberals on their claim that governments cannot generate sufficient jobs to satisfy the desires for work of the unemployed was a slippery slope. Standing continues to publish his fiction. My view is that would not help Labour recover from the shots they fired into their own feet in the period before the December election by listening to the likes of Standing and those who advocated the Fiscal Credibility Rule and the reneging on the Brexit commitment. They are motivated by a deep vein of social science and medical research that extols the virtues of work beyond its obvious income generation qualities. Pushing a UBI in the light of that research is just a pitiful bailout. On August 10,the Library of the Canadian Parliament released one of their In Brief research publications — How the Bank of Canada Creates Money for the Federal Government: Operational and Legal Aspects — which described the operational interactions between the Bank and the Canadian Treasury that facilitate government spending in some. It allows ordinary citizens to come to terms with some of the essential capacities of the currency-issuing Canadian government, which Modern Monetary Theory MMT highlights as a starting point towards achieving an understanding of how the monetary system operates. The description is in contradistinction to the way the mainstream macroeconomics text discuss this part of the economy. It leads to an analysis where we learn that the Bank of Canada holds a significant stock of government debt which it is allocated at auction time on an non-competitive basis.

Books by Tejvan Pettinger

As a member, you’ll also get unlimited access to over 79, lessons in math, English, science, history, and more. Plus, get practice tests, quizzes, and personalized coaching to help you succeed. Already registered? Log in here for access. Log in or sign up to add this lesson to a Custom Course. Log in or Sign up. The money multiplier is the amount of money that banks generate with each dollar of reserves. Reserves is the amount of deposits that the Federal Reserve requires banks to hold and not lend. Banking reserves is the ratio of reserves to the total amount of deposits. The money multiplier is the ratio of deposits to reserves in the banking system. Why is this important? Let’s take a look at an example to illustrate the power of banks to literally create money out of thin air. Imagine that you are president of a large bank.

Is the Money Multiplier Constant?

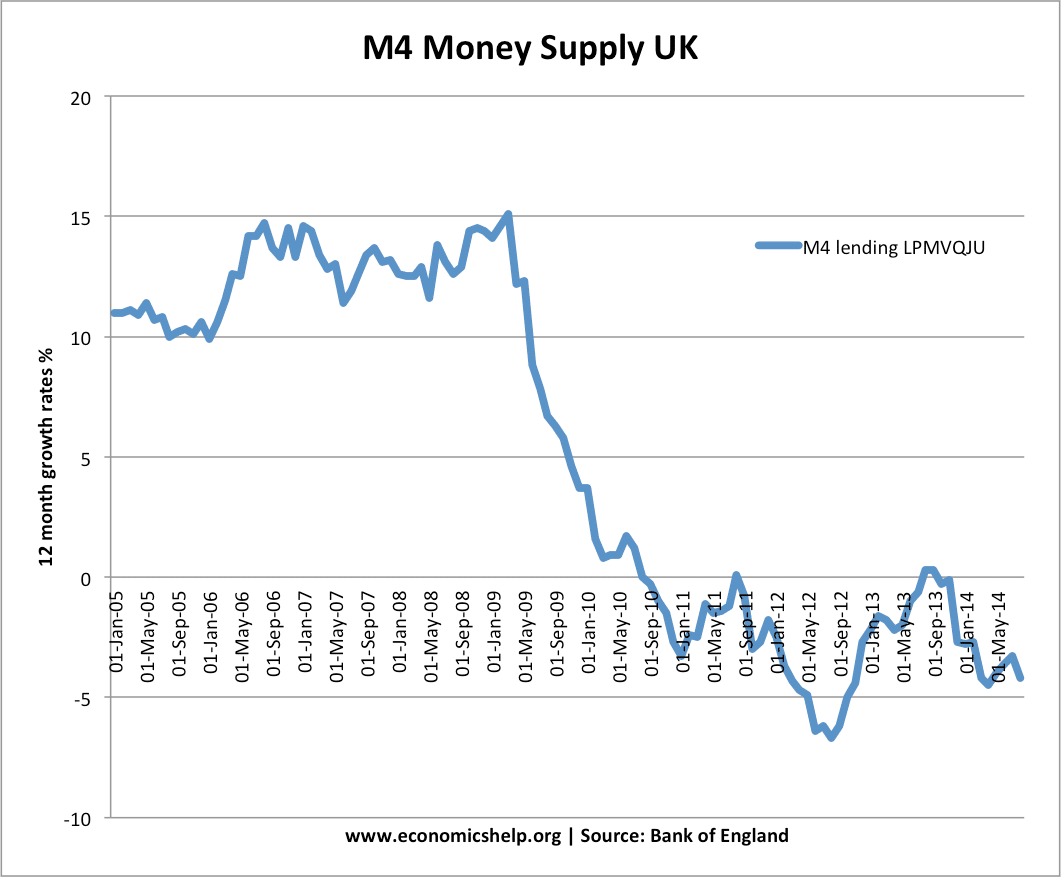

The Money Multiplier refers to how an initial deposit can lead to a bigger final increase in the total money supply. The money multiplier is Note: This example stops at stage In theory, the process can continue for a long time until deposits are fractionally very small. In theory, if a Central Bank demands a higher reserve ratio — it should have the effect of acting like deflationary monetary policy. A higher reserve ratio should reduce bank lending and therefore reduce the money supply. However, in the real world, there are many reasons why the actual money multiplier is significantly smaller than the theoretically possible money multiplier. The money multiplier model suggests banks wait for deposit and then lend out a fraction. For example, in the credit bubble of , many banks were lending mortgages by borrowing on short-term money markets. In Central Banks pursued quantitative easing.

You must create an account to continue watching

The multiplier effect refers to the proportional amount of increase in final income that results from an injection of spending. Alternatively, a multiplier effect can also work in reverse, showing a proportional decrease in income when spending falls. Generally, economists are usually the most interested in how capital infusions positively affect income. Most economists believe that capital infusions of any kind, whether it be at the governmental or corporate level, will have a broad snowball effect on various aspects of economic activity. Like its name, the multiplier effect involves a multiplier that provides a numerical value or estimate of an expected increase in income per dollar of investment. In general, the multiplier used in gauging the multiplier effect is calculated as follows:.

TRANSCRIPT

In a fractional reserve system like we have here in the United States, money is loaned out by banks and by law they are only required to have a fraction of the amount they loan. Upon extending the loan, the borrower possesses the million dollars, yet the lender feels that he still owns the million dollars that he lent. Because of this conviction, there is, in the minds of the debtor and the creditor combined, two million dollars worth of value where before there was only one. The central bank FED can adjust the reserve requirement to tighten or loosen the money supply. When inflation is raging, the central bank will often raise reserve requirements in an effort to reduce the money multiplier. As you can see from the reserve requirement chart as the reserve requirement decreases the multiplier effect increases. Even if the FED maintains a constant reserve requirement the money multiplier itself can change. In normal situations the simple fact that there is federal deposit insurance makes the banks less risk averse, after all they can always fall back on the government. This will reduce the money multiplier. In the M1 Money multiplier chart we can see that in the period from to the money multiplier ranged from above 3 to 1 down to below 1 to 1 with a drastic drop corresponding to the liquidity crisis. Contrary to the statement of Fed Chairman Ben Bernanke who claimed that the FED could simply drop cash from helicopters to reinflate the economy…back inNobel Prize winning economist Paul Samuelson said. By increasing the volume of their government securities and loans and by lowering Member Bank legal reserve requirements, the Reserve Banks can encourage an increase in the supply of money and bank deposits.

Comments

Post a Comment